Kin + Carta: Financial Services AI Still in “Early Stages”

Exclusive insights from Kin + Carta finds that the majority of financial services institutions are only now just starting to engage with generative artificial intelligence (Gen AI).

The company’s new research finds that only one in seven (14%) believe that AI is currently baked into their corporate strategy, alongside 26% of those surveyed admitting they are within the early stages of exploring use cases.

Meanwhile, although nearly half (43%) have a small number of proof-of-concept (POC) projects in development, alongside only around one in six (17%) say they currently have key AI initiatives in production.

The findings highlight that, whilst interest in Gen AI adoption within banks is increasing, financial institutions are still facing regulatory and security challenges.

The importance of clear AI implementation strategies

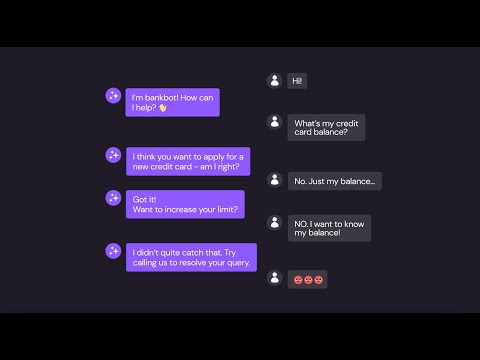

Currently, banking customers are open to AI within some use cases - such as fraud detection and efficiency reasons - but are nervous about potential risks such as data breaches. As a result, banks have been statistically slower to adopt the technology and are often unsure on the best strategic route to take.

More broadly, whilst businesses around the world are eager to obtain the latest AI models, they can often be unsure over how to actually implement the technology - which can lead to security issues and broadening skills gap concerns later down the line.

Kin + Carta’s findings highlight how financial services would now benefit from meaningfully thinking about their AI strategy. As a result, businesses can deliver more personalised financial experiences and therefore avoid missing out on the early advantages of AI adoption.

Likewise, having a clear AI strategy can lead to benefits such as improved efficiencies, enhanced customer experience and a competitive advantage.

“Given the critical role banks play in our societies, a cautious approach that prioritises internal efficiencies over customer-facing applications is understandable,” comments Phillip O’Neill, Director of Financial Services for Europe at Kin + Carta. “Several operational hurdles also exist to these projects, not least that data remains siloed across various systems.”

Phillip also notes that Gen AI shouldn’t be implemented simply because it’s available, advising that financial services institutions must prioritise their strategic goals and desired outcomes, then explore how Gen AI can contribute as a solution.

“This means fostering partnerships and an environment in which AI pioneers can innovate while still adhering to regulatory frameworks,” he says. “What’s clear is that Gen AI holds significant value for the customer journey. It's a thrilling time to be working at the intersection of financial services and technology, unlocking the potential of Gen AI.”

Kin + Carta, a leading digital transformation company, has also started to engage in Gen AI. In March 2024, the company announced a partnership with retail company Matalan to launch a new large language model (LLM) tool.

Using Google’s Vertex AI, the model uses product metadata and imagery to produce more detailed product descriptions for customers. As a result, Matalan customers can obtain more detailed information about its range of products.

**************

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024.

**************

FinTech Magazine is a BizClik brand.